Introduction

Fraudulent phone calls have become a global menace, with scammers using sophisticated tactics to deceive people into sharing personal information, transferring money, or granting remote access to their devices. From fake lottery winnings to banking fraud and government impersonation, these scams cause billions of dollars in losses every year.

Understanding these scams and knowing how to protect yourself is crucial. In this blog, we’ll explore the most common types of fake calls worldwide, how they operate, and the best practices to avoid falling victim to them.

What Are Fake Calls?

Fake calls, also known as scam calls or fraudulent calls, are deceptive phone calls made by criminals who pretend to be from a trusted organization (such as a bank, government agency, or company) to trick people into:

- Revealing personal or financial details (bank details, passwords, OTPs).

- Transferring money under false pretenses.

- Allowing remote access to their devices.

Scammers often use caller ID spoofing, meaning they can manipulate the phone number that appears on your screen. Even if the number looks legitimate, it might be a fraudster calling.

Now, let’s break down the most common types of scam calls worldwide.

Common Types of Scam Calls and How They Work

1. Banking and Financial Fraud Calls

Fraudsters pose as representatives from banks, credit card companies, or payment services (like PayPal, Venmo, or Zelle). They claim there is an issue with your account or transaction, and they need your OTP, PIN, or card details to fix it.

Examples:

- Fake KYC Update Calls: The scammer claims your bank account will be frozen unless you verify personal details.

- Credit Card Fraud Calls: The caller warns of suspicious transactions and asks for your card number to block them.

How to Avoid It:

- Banks never ask for OTPs, passwords, or PINs over the phone.

- If you receive such a call, hang up and call your bank’s official number from their websit.

- Do not click on links sent via SMS or email.

2. Lottery, Sweepstakes, and Prize Scams

These scams trick victims into believing they have won a lottery, prize, or contest they never entered. The caller demands “processing fees” or “taxes” to release the prize.

Examples:

- “Congratulations! You’ve won $50,000 in a global lottery. Please send a small processing fee to claim your reward.”

- “You won a free iPhone, but you need to pay shipping charges first!”

How to Avoid It:

- If you never entered a lottery, you haven’t won anything.

- Legitimate organizations do not ask for advance payments.

- Verify with official sources before taking action.

3. Government Impersonation Scams

Scammers pretend to be IRS, HMRC, Social Security, or local tax officials and claim you owe money in unpaid taxes. They threaten you with arrest, deportation, or legal action unless you pay immediately.

Examples:

- “This is the IRS. You owe back taxes. If you do not pay today, the police will arrest you.”

- “Your Social Security number has been suspended. Please provide your details to reactivate it.”

How to Avoid It:

- Government agencies do not demand payments over the phone.

- If in doubt, check the government agency’s website or visit their office.

- Do not share personal details with unknown callers.

4. Tech Support Scams

Scammers pretend to be from Microsoft, Apple, Google, or Amazon, claiming that your computer or phone is infected with a virus. They ask for remote access to “fix” the problem, but instead, they install malware or steal sensitive data.

Examples:

- “Your computer is sending error messages. We need to fix it remotely.”

- “Your Amazon account has been hacked. Please download our security app.”

How to Avoid It:

- Tech companies do not make unsolicited tech support calls.

- Never allow remote access unless you initiated the request.

- If you suspect an issue, contact customer support directly.

5. Charity and Disaster Relief Scams

Scammers take advantage of natural disasters, pandemics, or humanitarian crises to request donations. They pretend to be from well-known organizations like Red Cross, UNICEF, or WHO.

Examples:

- “We are raising funds for earthquake victims. Can we count on your donation?”

- “Help COVID-19 relief efforts by donating via this link.”

How to Avoid It:

- Donate only through official charity websites.

- Verify the organization’s legitimacy before donating.

- Never give financial details over an unsolicited call.

6. Investment and Cryptocurrency Scams

Scammers promise high returns on investments in stocks, real estate, or cryptocurrency. They may request an initial deposit, claiming you will make huge profits quickly.

Examples:

- “Invest $500 today and earn $5,000 in one week!”

- “Our expert traders will manage your crypto investments for guaranteed profits.”

How to Avoid It:

- Be wary of “too good to be true” investment offers.

- Verify investment firms through regulatory agencies (e.g., SEC, FCA).

- Do not transfer money to unknown individuals

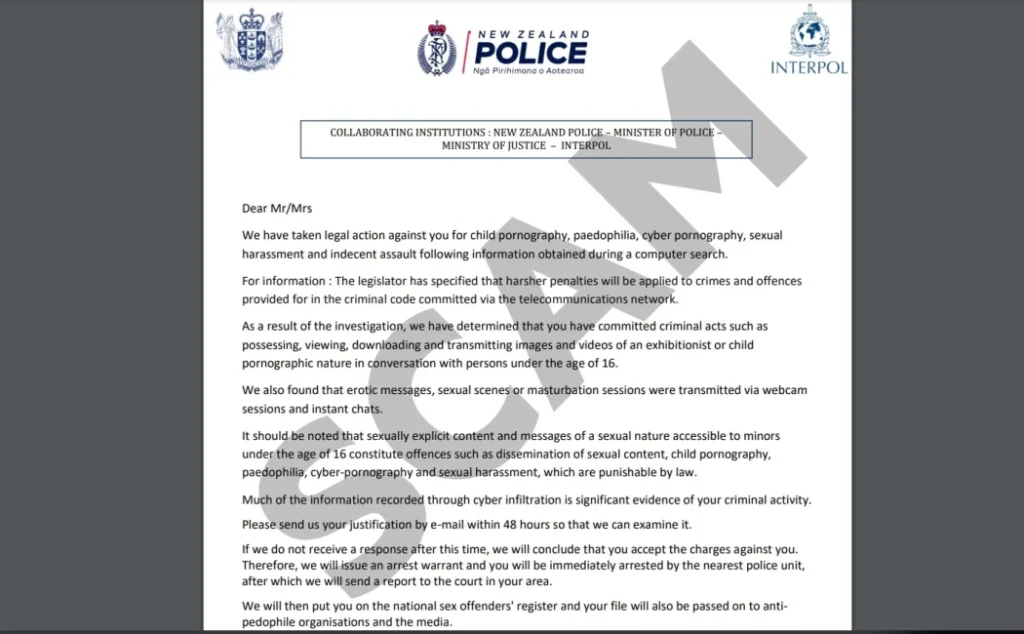

7. Police, Legal, and Court Scams

The scammer claims to be from Interpol, FBI, or local police, saying that you are under investigation. They demand money to clear your name.

Examples:

- “A case has been registered against you. Pay a fine now to avoid arrest.”

- “Your identity was used in criminal activity. We need a security deposit to confirm your innocence.”

How to Avoid It:

- Law enforcement agencies do not demand payments over phone calls.

- Verify by calling the actual police department.

- Do not engage with threats—scammers use fear tactics.

Real-Life Examples of Fake Call Scams

1. The Indian Bank Fraud Scam (2022) – ₹1.2 Crore Lost

What Happened?

- A businessman in Mumbai received a call from someone claiming to be a bank representative.

- The scammer informed him that his KYC (Know Your Customer) details were outdated and needed urgent updating to prevent account suspension.

- The victim was asked to share his bank account details, ATM PIN, and OTP to complete the process.

- Within minutes, scammers withdrew ₹1.2 crore ($145,000) from his account.

Lesson Learned:

- Banks never ask for OTPs or PINs over the phone.

- If you receive a suspicious call, hang up and contact your bank directly.

2. Fake Amazon Customer Support Scam – Woman in Germany Loses €5,000

What Happened?

- A woman got a call from someone claiming to be from Amazon.

- The scammer said there was suspicious activity on her account and asked her to confirm her credit card details.

- She later saw multiple unauthorized transactions totaling €5,000 ($5,400).

Lesson Learned:

- Amazon never calls customers for payment verification.

- Always check transactions directly in your account.

3. The Tech Support Scam – Microsoft Impersonation in Canada

What Happened?

- A man in Toronto received a call from someone claiming to be a Microsoft support technician.

- The caller said that his computer had a dangerous virus and they needed remote access to fix it.

- Once the scammer gained access, they locked the man out of his own computer and demanded $500 to unlock it.

- The victim had to pay the ransom to regain control of his computer.

Lesson Learned:

- Tech companies never make unsolicited calls for computer issues.

- Never allow remote access unless you personally contacted customer support.

4. UK Police Impersonation Scam – Man Loses £200,000

What Happened?

- A retired man in London got a call from someone pretending to be a police officer.

- The scammer said the man’s bank account was compromised by criminals, and the police needed his help to catch the fraudsters.

- He was told to transfer £200,000 ($250,000) to a “safe account” set up by the police.

- After transferring the money, he tried to contact the police and realized there was no such operation.

Lesson Learned:

- Police will never ask you to transfer money for an investigation.

- If someone claims to be a police officer, call the police department directly to confirm.

Key Takeaways from These Scams

- Do not share personal or banking details over the phone – Banks, government agencies, and tech companies never ask for confidential information over calls.

- Avoid urgency traps – Scammers try to create panic by saying “act immediately” or “your account will be blocked.” Always verify before taking action.

- Never pay through gift cards, cryptocurrency, or wire transfers – Scammers prefer these payment methods because they are hard to trace and irreversible.

- Verify the caller’s identity – If someone claims to be from a bank, government agency, or company, call their official helpline to confirm.

- Be skeptical of unexpected winnings or job offers – If you never entered a contest or applied for a job, it’s likely a scam.

How to Identify a Scam Call?

While some phone scams are still fairly easy to recognize, others require more careful attention. Here are the main warning signs to look out for

- You receive an unsolicited phone call. Beware of calls from people claiming to represent government agencies or major corporations. Scammers pose as people with authority as an intimidation tactic. Be especially cautious about callers claiming to be from the IRS, DMV, FBI, or large companies like Amazon, Apple, Microsoft, or Netflix.

- You’re offered a too-good-to-be-true deal or giveaway. Don’t believe anyone who says you’ve been “specially selected” for a prize. If you didn’t enter a lottery or request a deal, it’s most likely a scam.

- There’s a noticeable pause when you pick up before anyone answers. This is the scammer’s call technology connecting you to them when you answer.

- The call starts off as a robocall. There are federal laws in place that prohibit most forms of robocalls [*]. If you didn’t request or give permission to receive this kind of marketing call, it’s a scam.

- The caller claims you have unpaid debts and threatens you with fines or jail time. This is a classic intimidation tactic. When in doubt, hang up and contact the company or agency directly to see if the threats are credible.

- The caller uses a generic greeting and doesn’t know anything about you. Someone requesting money or personal information will always know whom they’re calling.

- The caller requests sensitive information, such as your SSN or credit card number. There’s never a good reason to give out this information over the phone.

- You’re asked to provide personal information that the caller should already have. For example, a representative from Medicare should not be asking for your Medicare number. Don’t be fooled by someone asking you to “verify” your information. Remember, they called you.

What Happens If You Answer a Spam or Robocall?

Spam calls are unwanted calls designed to trick recipients into giving up money or sensitive information.

Fraudsters may pose as telemarketers, representatives from government agencies like the Internal Revenue Service (IRS), your bank, or even a health insurance company. In other cases, scammers use “robocalls” to target millions of victims with pre-recorded messages.

Unfortunately, the rate of phone scams has exploded over the past few years.

In 2022, Americans were bombarded by 50.3 billion spam calls. Even worse, over 60% of those spam calls are scams — totaling roughly 30 billion per year .

The massive volume of spam calls is part of a scammer’s strategy. Spam callers make tens of thousands of calls a day, hoping that a small percentage of people will answer them and engage in conversation. The longer they can keep the person on the line, the more likely they’ll be able to extract valuable information from their unwitting targets.

So what can happen if you answer a scam or spam call?

1. Scammers could record (and use) your voice

Some robocall scams are simply designed to get you to say certain phrases like “yes” or “stop.” While you might think you’re stopping the spammer, in reality, they’re recording your voice and can use it to break into your bank account, change backup phone numbers or email addresses, or scam your closest friends and family members.

The bottom line: In most cases, simply answering a spam or robocall won’t put you at serious risk. As a rule of thumb, never provide information, money, or access to anyone who calls you. If in doubt, always hang up and contact the company or agency directly using the contact information provided on its website.

2. Hackers can break into your online accounts

Some spam callers use a different phishing strategy to gain access to people’s Amazon or other online accounts.

They tell victims that there was an order placed for an expensive item like a phone or TV. Afraid of being liable for that purchase, the victims share their account information with a “customer representative.” The scammer then uses the login information to make a series of purchases, some totaling over $20,000.

3. You could get targeted by a tech support scam

Another way scammers have found success is by pretending to be technicians from well-known computer companies — like Apple, Microsoft, or the Best Buy Geek Squad. They tell you there’s an issue with your computer and that they need remote access to repair it . At this point, the scammer may:

- Perform what looks like a diagnostic test but is actually malware installation.

- Force you to pay them for their “work” and ask you to log in to your bank account to make a direct transfer.

- Tell you they need to be paid for the fix in Amazon gift cards, and steal your login credentials.l

4. You could lose money

When scammers get you on the phone, they try their hardest to obtain your bank account passcodes, passwords, account numbers, or even answers to your security questions (like your mother’s maiden name). If you accidentally reveal that information, hackers can drain your account.

Many phone scams may also pressure you into sending money to the scammers or buying gift cards and reading out the numbers on the backs of the cards. If you do this, the money is gone almost instantly.

5. You could become the victim of identity theft

Phone scammers are notorious for impersonating government agencies and companies that you trust. To put you on edge, they’ll tell you an account was hacked, or you’re under investigation.

Most times, their explanations are scary enough to convince you to share your Social Security number (SSN), Medicare number, or credit card details. Once you give up your data, you’re at serious risk of identity theft.

Take action: If scammers have your phone number, your bank account and identity could be at risk. Get 33% off Identity Guard’s award-winning identity theft protection, and secure yourself and your family against scammers.

Did You Accidentally Give a Phone Scammer Information? Do This

If you’ve given a phone scammer your sensitive information, responded to a robocall, or sent money or gift cards, you need to act quickly to protect your accounts and finances.

Here’s what to do:

- Secure your online accounts. Update your passwords to ensure each one is strong, complex, and unique. Whenever possible, enable two-factor authentication (2FA) to enhance your cybersecurity.

- Freeze your credit. Call or go online to request a freeze at all three credit bureaus — Equifax, Experian, and TransUnion. This prevents scammers from opening new accounts or taking out loans in your name.

- Try to get your money back. Work with your bank, credit card issuer, or Identity Guard’s Fraud Resolution Specialists to understand and execute the necessary steps for recovering your losses.

- Report the fraud to the FTC and any impacted companies. Report your case to the FTC at ReportFraud.ftc.gov and explain what happened to any bank or organization involved. The more detailed information you can provide, the higher the chances are of retrieving your money.

- Sign up for identity theft protection. It’s tough for anyone to track every single one of their accounts and make sure their personal information is safeguarded. Identity Guard does the work for you with award-winning identity theft protection, credit monitoring, and $1 million coverage for eligible losses due to identity theft.

How To Stop Spam Calls From Taking Over Your Phone

Phone scams and spam have reached epic proportions in the past few years — so much so that the FCC recently mandated that U.S. carriers adopt Stir/Shaken technology to block international phone scammers from spoofing phone numbers with local area codes.

Unfortunately, many Americans are still being bombarded by spam calls all day long.

Here’s what you can do to reduce the amount of spam calls that you receive:

1. Use spam call-blocking tools from your carrier or third parties

Mobile carriers like Verizon, AT&T, U.S. Cellular, and T-Mobile offer anti-spam tools to their customers. Consider activating those apps and reporting any spam numbers to your carrier directly.

You can also install other third-party apps, such as Truecaller and Nomorobo to automatically filter incoming calls and text messages for spam.

2. Enable features on your phone that silence or block spam calls

On an iPhone, users can block and silence phone numbers they’ve never been in contact with (and don’t have saved in their contacts lists). Go to Settings → Phone → and then toggle on “Silence Unknown Callers.”

Android phones have a similar feature. Open the Phone app → tap the three dots → Settings → tap Caller ID & Spam protection in the Assistive section → “Filter spam calls.”

3. Make your phone number less accessible to scammers

The FTC urges anyone who has received consistent spam calls to add their phone number to the National Do Not Call lists. It’s illegal for most companies to call you if your number is on these lists.

You can add your number to the Do Not Call Registry online and file spam telemarketer call complaints through DoNotCall.gov.

Unfortunately, this will only limit the amount of telemarketing calls you receive, as scammers don’t follow these rules.

If no other options are working, you may need to choose the most nuclear option: changing your phone number.

Conclusion

Scam calls are a global problem, affecting millions of people every year. Whether it’s a fake bank alert, government impersonation, or tech support fraud, scammers rely on fear and urgency to manipulate their victims.

By staying alert, verifying calls, and never sharing sensitive information over the phone, you can protect yourself from fraudsters.

If you ever receive a suspicious call, remember: Stop, Think, and Verify before taking any action. Stay safe, stay informed!